What is the Florida Freedom Summer Sales Tax Holiday?

The Florida Senate passed legislation establishing the Freedom Summer Sales Tax Holiday to provide savings for individuals and families enjoying music, sporting, theater and other entertainment events. During this time, purchases of admissions to these events will be tax-free under the terms outlined below.

What are the dates of this tax holiday?

The Florida Freedom Summer Sales Tax Holiday begins Monday, May 29, 2023, and ends Monday, September 4, 2023. It includes events held from May 29, 2023 through December 31, 2023.

What types of Ticketmaster purchases are eligible to receive this tax exemption?

Tickets purchased on Ticketmaster for live events held in the State of Florida from May 29, 2023 through December 31, 2023 — including concerts and festivals, sporting events, plays, musicals, and other cultural events — may be exempt from sales tax. However, additional services purchased (such as parking, memorabilia, etc.) may not be eligible for a sales tax exemption.

Who is eligible for a tax exemption?

Anyone who purchases a ticket for an eligible 2023 Florida event between May 29, 2023 through September 4, 2023 is eligible for a tax exemption.

What is the tax-exempt rate?

The total tax rate is determined at the county level. Please check your venue’s local sales tax rate to calculate your exemption.

How will I receive this tax exemption?

How you receive this tax exemption will depend on the type of ticket selected and the method of payment used at the time of purchase. In most cases, you will see your tax exemption refund within one (1) business day, but this can vary depending on your bank’s policies. This exemption may be:

- In the form of a “$0 sales tax” at checkout (if no tax was charged during purchase)

- As a refund to your original method of payment used at the time of purchase (e.g., your credit card) for the sales tax portion of the total order

- As a gift card (if you purchased via a voucher or gift card)

Why am I still seeing tax included at checkout?

In many cases, sales tax is included in the total ticket price. The sales tax amount charged at the point of sale for eligible items within your order will be refunded to you within one (1) business day of your order processing to your original method of purchase. Note that processing time may vary depending on your bank’s policies.

Will my receipt (in my online account) or my Order Confirmation email display my tax exemption amount?

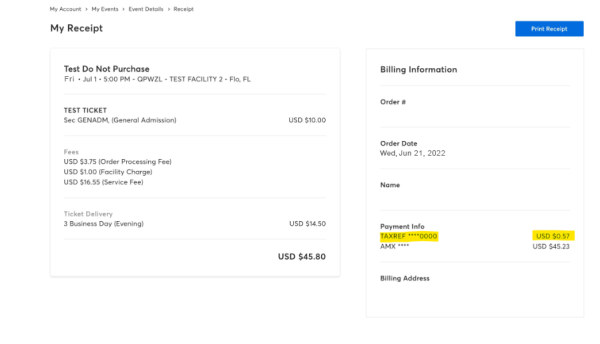

If tax was included in your purchase price, the confirmation email you receive — and your online receipt — will show the initial full charge and will not display your tax-exempt pricing. Once you have received your tax exemption, you will see this updated and reflected on your receipt in your account under the line TAXREF.

What if my event is postponed or rescheduled?

Tax-exempt eligibility is based on the date of the event when originally purchased. If the event is rescheduled to another date outside of the promotional period, you will not be charged tax for that event.

If I exchange, upgrade, or add additional tickets to my order after September 4, 2023, will I be charged tax if there are additional charges?

Any additional charges (e.g., adding another ticket to your order after September 4, 2023) will be subject to regular taxes and not qualify for tax exemption.